Back to a couple years ago we talked about using excel to build a dynamic dashboard to show the financial results, then we talked about how those business intelligence tools such as Qlikview or Tableau change the way of the accountants representing the figures.

Now translating troves of financial data into accessible visual analytics is even getting so much easier. You don’t need to export data into the excel spreadsheet to manipulate it anymore, as it can’t be drilled down to show the real figures behind the scene; you also don’t need to hire someone to implement BI tools and build templates for you either, it is costly.

How?

Xero and Microsoft Power BI enabled interaction between their software. They aim to give businesses a freedom to get insight of their business.

*The amounts shown are for demonstration purposes only

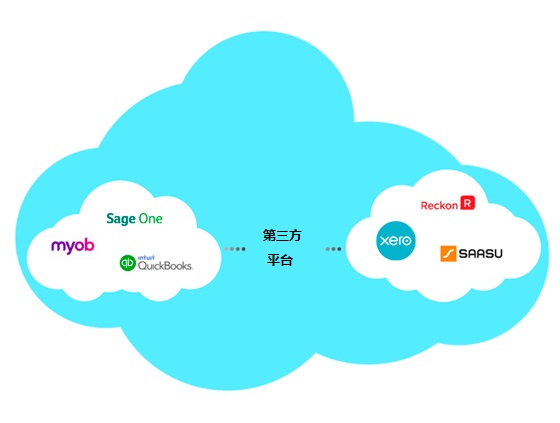

Xero is one of the well-known cloud accounting systems in the Australian market, and Microsoft Power BI is a widely used tool for analysing and visualizing data.

Xero’s free integration gives Xero users the ability to create reports with pre-configured information and graphs, to customise those reports and to write their own. Power BI graphs can also be shared very easily (compared to Excel) by embedding them in websites, blogs or Powerpoint slides, or printed.

Power BI’s strength lies in its ability to visualise metrics that businesses expect answers about their cash position(first of the first in SME), profit/loss, revenues vs. expenses, trend, and return on investment.... here is the list of reports so far:

- Closing Balance

- Daily Cash Flow

- Action Items

- Closing Balance

- Cash In

- Cash Out

- Outstanding Receivables

- Overdue Receivables

- Invoices Due

- Revenue % Growth Revenue

- Invoiced Sales by Customer

- Outstanding Payables

- Overdue Payables

- Bills Due

- Expense & Growth

- Expenses

- Billed purchases by Supplier

- Monthly Sales

- Net Profit

- Monthly Profit & Loss

- Top Expense Accounts

- Total Assets

- Total Liabilities

- Equity

- Current Ratio

- Total Liabilities to Equity Ratio

- Return on total assets

- Gross profit percentage

*The amounts shown are for demonstration purposes only

To many SMEs, those metrics are good enough to give you a brief about business status in term of the finance. Although it looks a lot information inside but fortunately the layout is designed to be neat and smooth by using bar charts and purely numbers, especially when it is browsed on the mobile phone, and you are even able to move the tabs to the position wherever you want.

The dashboard is the hub for Power BI. Users can delve into their data to gain greater insights and discover actionable solutions. Plus dashboards can be shared quickly with those who need them most inside the business.

Action items offer a ‘to-do list’ approach to keep your business day up-to-date each day. Direct links to Xero and live-data transforms managing cashflow into a step-by-step process.

Inventory reports get your business looking forward. They offer insights into your best customers and which products or services are popular. Where business improvement analytics were once cost and time prohibitive, inventory reports offer actionable results in minutes.

Learn more about how Xero and Power Bi work together, please contact New E

Tom Yang

Learn more about how Xero and Power Bi work together, please contact New E

Tom Yang